At a young age, we are naturally faster at picking up new things, therefore this is the best time in a child’s life to teach them about money management and how to save. However, we often find that financial discussions are only spoken amongst the “adult tribe” when youngsters are not present.

It is, therefore, crucial to break down this norm to mold the malleable minds of the young to set them on the right path to financial freedom.

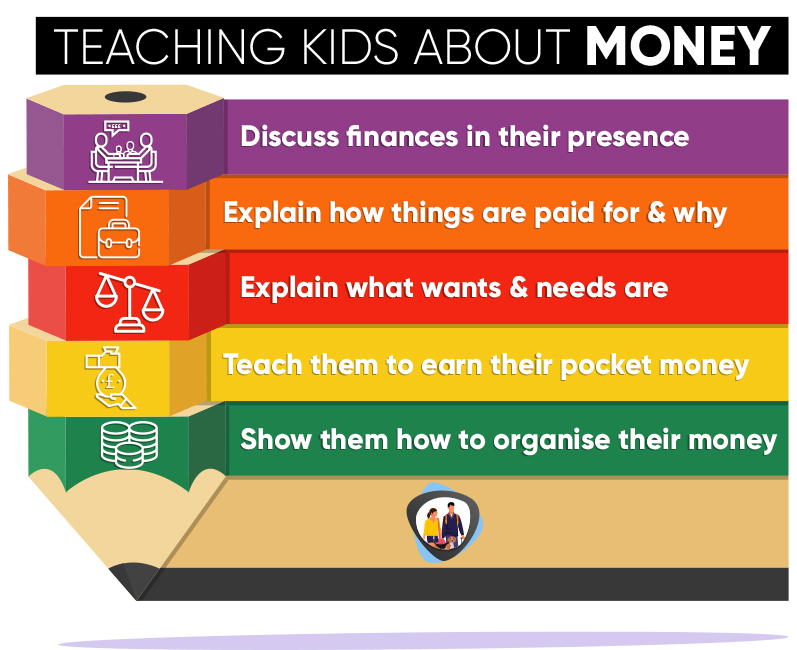

Once you know you child’s learning style, you can apply this to the below lessons to teach your kids about money

1. Have financial conversations when they are present

Firstly, you should talk about your finances around them all the time. It is particularly important to talk about money related topics. Kids can learn about investment, bank rates, cheques, saving money, and credit cards at a young age and will pick up many of these things from listening to you.

Having all these topics for discussion will make them comfortable with money and put them ahead of the curve when the time comes for their independence.

2. Explain how things are paid for and why.

Set an example. Children watch everything we do, so explain how you pay for things and why you are buying them. Explaining how you made your money, be it through working, investments, or other avenues, will show them the value of each pound earned and why you should spend it wisely. Show them how much it actually costs to run a house!

If you cannot justify an expenditure to your child, was it really a necessary purchase? Lead by example!

3. Teach them the difference between wants and needs

Leading on from the above, it is crucial to explain the difference between a want and a need. This will set them on the right path for the rest of their life as every time they go to make a purchase, they will have an innate thought process of whether they need it or want it. I follow this same process, often at the very last minute during the checkout stage online. I have left many abandoned carts in my days.

To explain it very top level, the difference between a want and a need is a want is yearning for something where it is not necessary for your everyday life, whereas a need is something that is crucial, essential for your day to day life. E.g. Purchasing the newest game console is a want, paying your heating and water bills is a need

4. Do not just give them pocket money

Fourthly, instead of giving your kids an allowance just for being your kids, teach them to earn it through chores or different tasks in your house. This will help them understand and appreciate the value of every penny earned. And to go one step further, explain to them the price of the latest game console in terms of chores required and hours needed to be worked before they can buy it.

5. Teach them how to organise their finances

Lastly, organize your child’s money into three separate pots: one for saving, one for paying for phone contracts/ subscriptions (if they have any), and one for everyday spending. When they grow older, they can transform these into their own bank accounts.

Having an account for saving and everyday spending is self-explanatory, however, having a pot for paying for any phone contracts and streaming subscriptions will ultimately transform into and help them understand paying monthly bills. This should hopefully help them become financially independent.

James Banerjee is a Senior SEO Manager at The AA who graduated from the University of Kent in 2014. He works at The AA, looking after the Financial Services and Cars sections on the website. Prior to this he was an Account Director working with clients such as HSBC UK and Nestle. He has a keen interest in personal finances and money-saving advice.