Dog insurance is like a safety net for you and your dog. You hope that you will not need it, but it is better to have it and not need it than to need it and not have it. Pet insurance is there for those unplanned/unexpected vet trips and is worthwhile looking into when figuring out the cost of keeping a dog.

For example, one day during the summer of 2018, Ella had a loose bowel movement and over the course of the morning, became very lethargic. We took her to the vets and she was immediately taken in the back and put on an IV drip.

We are still not exactly sure what happened, it may have been a combination of things, but by the evening of that same day she was doing much better and we took her home.

As Ella needed to have some tests done and was put on an IV, the vet bill came in quite high at £519. In our worry over Ella, we couldn’t even remember the name of our insurance provider, but luckily I had just received my pay from work and so was able to pay the bill upfront. I then claimed back the money (minus the excess) from our insurance provider a few days later.

This was an unexpected and quite high expense, and so without being able to claim back some money from the insurance, it would have been a very tight month for us. Thankfully, we have not needed to use the insurance since, but I am glad it is there just in case we ever need it again.

What are the different types of dog insurance?

- Accident only

- Time limited

- Maximum benefit

- Lifetime

Accident only pet insurance

Tends to be cheaper but your dog will only be covered in the event of an accident, so your dog will not be covered for illnesses.

Time limited pet insurance

Covers accidents and illnesses for up to 12 months. Cheaper than lifetime insurance and usually does not have an age limit. Can be useful if you have an older dog and your current lifetime insurance premiums are too expensive to maintain. The downside is you will only be able to make a claim for a specific condition once.

Maximum benefit pet insurance

Covers accidents and illnesses, you can claim for each injury/illness up to a specified limit. Useful in that you can claim for the same condition more than once if you are still within the limit. Once you have reached the limit, you will not be covered for it anymore, however other unrelated conditions are still covered (until you reach the limit for them).

The limit is not reset each year, so for example, if your limit is £1,500 and in 2020 you put in a claim for £1,200, you will only have £300 left to claim for that condition in the future.

Lifetime pet insurance

Generally, the most comprehensive but expensive option. You can claim for any conditions up to the set policy limit each year, the limit will then reset in the following year.

If your dog develops a long-term condition whilst you have lifetime insurance, it will be covered if you continue to renew. However, most policies will not cover a pre-existing condition (that is, something your dog had before you took the insurance policy out).

It is also worth noting that your insurance premiums will likely increase each year at the time of renewal, especially as your dog gets older. If the insurance premiums increase too much, you can choose not to renew but bear in mind that any pre-existing conditions your dog has developed whilst covered by the current insurance policy are unlikely to be covered if you change insurance providers (as will be considered a pre-existing condition).

Additionally, if your dog is older, it might be hard to find a cheaper insurance provider with the same levels of cover.

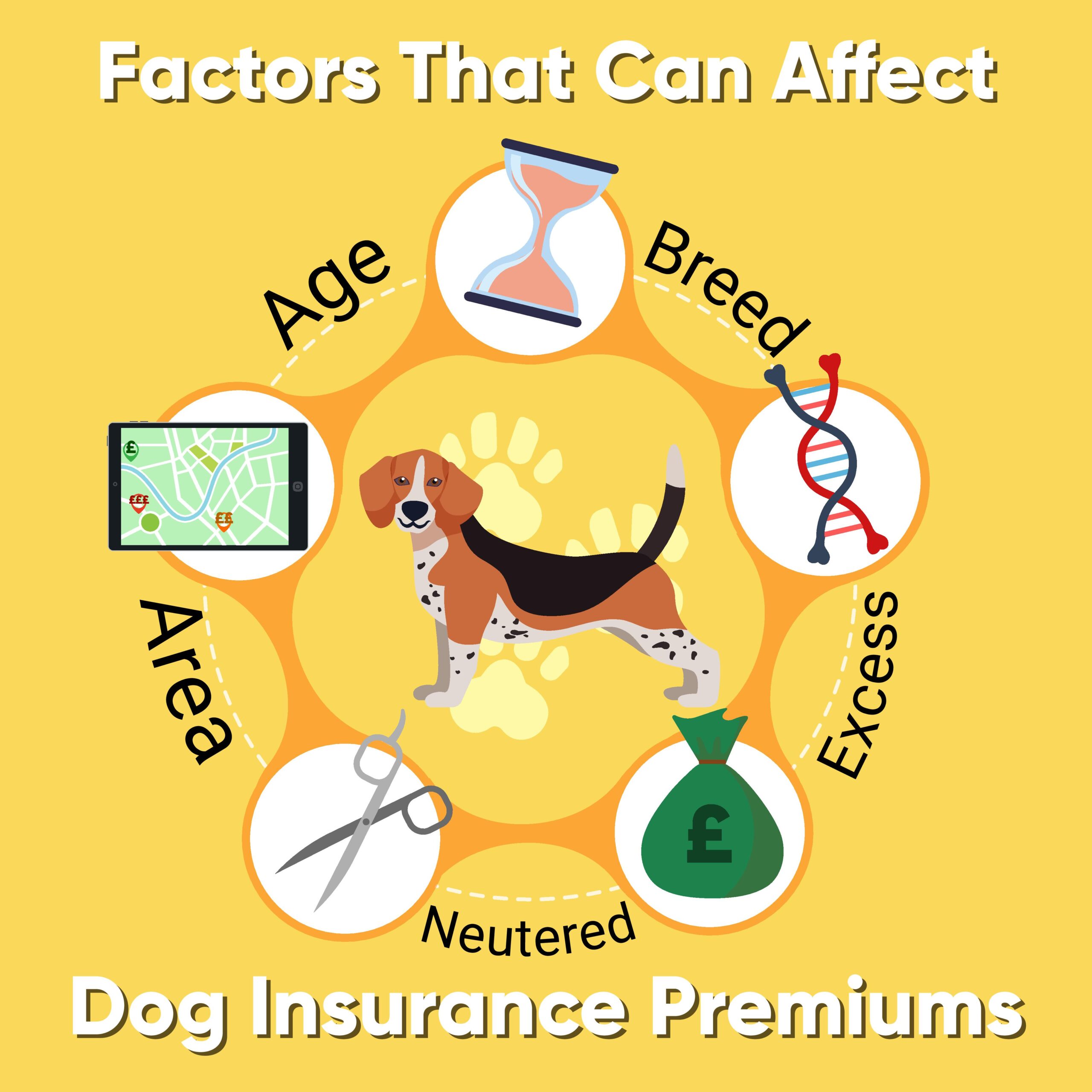

What can affect the cost of dog insurance premiums?

- Age

- Breed

- Excess

- Neutering

Age

When dogs age, they tend to become more susceptible to health issues. As such, insurance premiums tend to be higher for older dogs as insurance companies deem them as higher risk. Therefore, it is best to get dog insurance when your dog is young and healthy.

Breed

Pedigrees tend to be more expensive to cover as they are more prone to hereditary conditions

Some insurance policies may exclude certain breeds of dog that are typically used as working dogs e.g. security, racing, or farm work (as may be more likely to have claims to cover vet bills or legal action). Most insurance policies won’t cover dogs listed in the dangerous dogs act.

Excess

When looking for insurance, if you accept a higher excess your premiums may decrease. Though keep in mind you will need to pay the excess in the event of a claim – so if you have an excess of £200, and you make a claim to cover a vet bill of £300, you will need to pay the first £200 yourself and will only get £100 back in the claim.

Neutering

If your dog is not neutered yet and you are not going to breed them, consider getting this done as not only can it reduce insurance premiums, it also has some positive health benefits such as reducing the risk of some infections and cancers.

What to consider when applying for dog insurance?

Getting the best deal

To get the best deal, do some research and use comparison sites. Remember that the best deal is not always the cheapest option. When looking for dog insurance, work out what you can afford to pay in terms of monthly premiums and then consider what level of cover best suits your dog.

Also, consider what you will be able to pay in excess if you need to submit a claim.

Terms and conditions

Ensure you read through the terms & conditions and exclusions for a policy.

The cooling off period

Most policies have a cooling-off period, during which time (usually 14 days) you will be unable to put in a claim. This means if your dog becomes unwell during this time and requires veterinary treatment, you will need to pay for it yourself.

Pre-existing conditions

Most policies will not cover pre-existing health conditions, preventative treatments, or non-essential treatments. For example, routine treatments such as worming, flea treatment, and check-ups are usually not covered.

Dental and cosmetic treatments are also usually excluded, as well as treatments related to neutering, breeding, pregnancy, and giving birth.

High risk breeds

Most insurance providers will exclude dogs that are listed in the Dangerous Dogs Act. Some will also exclude certain breeds that are considered to have certain personality traits that they consider a higher risk e.g. those that are deemed to be more aggressive and/ or territorial.

Frequently asked questions

How much is dog insurance?

There is no set price for dog insurance, however there are many factors that will influence the over monthly cost: Breed, your geographic location, policy type, and dog age. According to a 2020 study by Bought By Many, the annual cost of dog insurance is £436.02, or £36 a month.

Is it worth insuring an old dog?

As dogs age, they tend to become more susceptible to health issues. As such, insurance premiums tend to be higher for older dogs as insurance companies deem them as higher risk. It, therefore, depends on how old the dog is and your own financial situation.

Does dog insurance cover dental cleaning?

Dental and cosmetic treatments are also usually excluded from most policies. Dependent on the level of cover you have chosen, it may cover treatment if your dog’s teeth are accidentally damaged.

Can I insure my dog with a heart murmur?

Yes, you can insure your dog if it has a heart murmur. Should any health issues arise that are causally related to the murmur, these will not be covered.

How do I get dog insurance?

There are many ways to get insurance for your dog, the most popular being using a comparison website, such as Comparethemarket. You can also apply directly on the insurance company’s website.

Sharne is an HR and Office Administrator with a degree in Classical & Archaeological studies. She has a passion for dogs and loves to share money management tricks in her spare time!